Dans notre enquête l’état de la criminalité financière en 2023, plus d’un professionnel de la conformité français sur trois a cité le risque d’atteinte à la réputation comme le facteur le plus susceptible d’entraîner un changement au sein de son […]

Dans notre enquête l’état de la criminalité financière en 2023, plus d’un professionnel de la conformité français sur trois a cité le risque d’atteinte à la réputation comme le facteur le plus susceptible d’entraîner un changement au sein de son […]

Les manifestations qui ont eu lieu à Ottawa et aux frontières entre les États-Unis et le Canada en 2022 ont sensibilisé le monde entier au problème de l’utilisation des plateformes de crowdfunding (financement participatif) pour financer des groupes extrémistes. Le […]

À l’aube de 2023, notre équipe chargée des affaires réglementaires explore certaines des tendances auxquelles les équipes Conformité des établissements financiers devraient être confrontées au cours de l’année à venir. Les deepfakes vont alimenter la fraude à l’identité synthétique Alors […]

Annonce de radiation L’Autorité des marchés financiers (AMF) a radié BYKEP SAS le 22 septembre 2022 en raison du constat que ce prestataire de services sur actifs numériques (PSAN) avait failli dans son obligation de lutte contre le blanchiment des […]

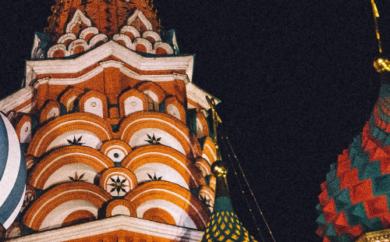

Qu’est-ce que SWIFT ? Le système Swift (pour Society for Worldwide Interbank Financial Telecommunication) facilite les transactions financières et les transferts d’argent pour les banques du monde entier. Supervisé par la Banque nationale de Belgique, ce système permet d’effectuer des […]

L’entreprise Monneo est un fournisseur d’IBAN virtuels pour les cybermarchands et les sociétés de la Fintech B2B. La société fournit, via une plateforme unique, de multiples comptes bancaires dans plusieurs banques aux cybermarchands. Les principales solutions comprennent SWIFT multidevises pour […]

L’entreprise IPT Africa est un fournisseur de services de paiements réglementé qui permet à ses clients de gérer et d’effectuer des paiements depuis une interface unique sur tout le continent africain. Couvrant toutes les devises africaines, en temps réel, avec […]

TransferMate is one of the world’s leading B2B payments infrastructure-as-a-service companies. Based in Ireland, the company enables individuals and businesses to make seamless, cost-effective cross-border payments in more than 201 countries and 141 currencies.

Stimulée par les progrès de la technologie blockchain, la propagation des cryptomonnaies a introduit de nouvelles possibilités financières dans les juridictions du monde entier. Cependant, les opportunités et les avantages liés aux cryptomonnaies sont accompagnés de nouveaux risques, les criminels […]

La 5ème directive anti-blanchiment de l’Union européenne (5AMLD) est entrée en vigueur dans tous les États membres le 10 janvier 2020. Cette directive a défini une série d’exigences et d’amendements à la législation anti-blanchiment de l’UE, y compris l’introduction d’une […]

La lutte contre la criminalité financière passe indéniablement par une bonne connaissance des clients. Si les réglementations actuelles en matière de lutte LCB/FT recommandent simplement d’adopter une approche fondée sur les risques, elles s’en remettent toutefois largement au bon sens […]

Disponibles depuis les années 1990, les cartes de crédit prépayées se sont fortement popularisées vers la fin des années 2000 et ont continué à s’imposer au cours de la décennie suivante. À tel point qu’elles devraient représenter, d’après des analystes, […]